Analysis of Maintenance Collection Percentage: Are New Assumptions Adding Unnecessary Burden on Prompt Payers?

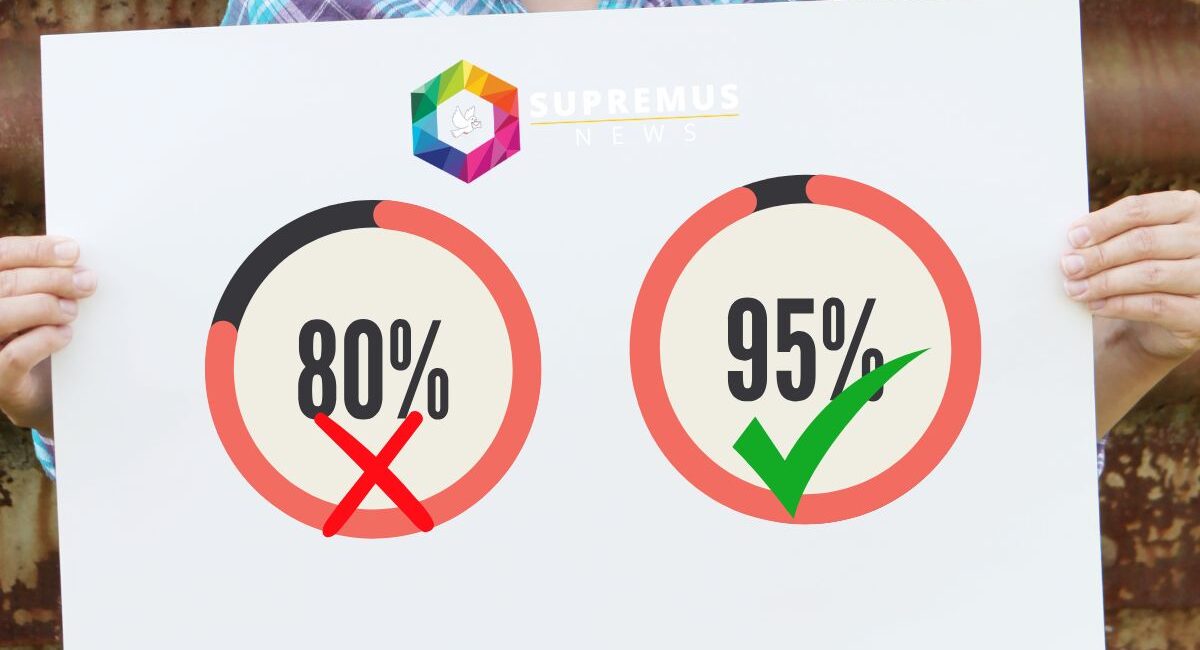

The recently analyzed data from January to September 2024 provides critical insights into maintenance collection percentage / trends at Casagrand Supremus. With an average collection rate of 95%, the report highlights the strong financial commitment of residents toward maintaining the community. However, the current management’s 80% collection assumption has raised serious concerns, as it appears to unjustly shift the burden onto prompt payers to cover inefficiencies and justify additional fund collection.

Key Highlights from the Report:

- Strong Maintenance Collection Performance (Jan-Sep 2024):

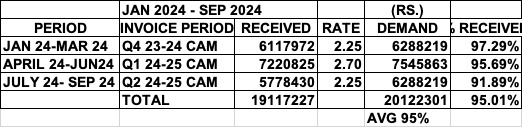

- Q4 23-24 CAM: 97.29% collection at ₹2.25 per sq. ft.

- Q1 24-25 CAM: 95.69% collection at ₹2.70 per sq. ft.

- Q2 24-25 CAM: 91.89% collection at ₹2.25 per sq. ft.

- Overall Average: 95.01% across three quarters.

This track record demonstrates the residents’ continued commitment to fulfilling financial responsibilities.

- Unnecessary Fundraising Due to Flawed Assumptions:

- Despite the 95% collection average, the current management has based their planning on an 80% collection assumption.

- By underestimating collections, the management is unnecessarily asking for additional funds from prompt payers.

- Instead of addressing inefficiencies, they are choosing to impose an unjustified financial burden on those who have been consistent in paying their dues.

- Shift of Responsibility:

- It appears that this assumption is being used to cover the inefficiencies of the current management, rather than making efforts to collect outstanding dues from defaulters or commercial tenants.

Questions for the Current Management:

- Why the Unreasonable Assumption? With historical data showing a consistent 95% collection rate, what rationale does the management have for lowering the projection to 80%? Is this assumption being used to mask inefficiencies or oversights?

- Impact on Prompt Payers: How does the management justify placing an additional burden on prompt payers, who have already demonstrated financial discipline? Why are defaulters and outstanding commercial dues not the primary focus?

- Transparency in Financial Planning: What steps have been taken to ensure that budgeting and fund collection align with historical data and actual requirements? Why hasn’t the management clarified the necessity for additional funds when collections are already healthy?

- What About Commercial and Defaulter Collections? Residents have repeatedly raised concerns about the recovery of outstanding amounts from defaulters and commercial tenants. Why hasn’t this been addressed before seeking extra funds from the community?

Resident Concerns:

Residents have consistently met their financial obligations, as evidenced by the 95% collection rate. However, the current management’s flawed assumptions and inefficiencies are shifting unnecessary financial pressure onto prompt payers, creating frustration and distrust. Instead of focusing on recovering dues from defaulters and commercial vendors, the management appears to be passing the buck to those who have been compliant.

Call to Action:

Residents must demand answers from the management on these critical points. Decisions impacting the community’s financial health should be based on facts, not arbitrary assumptions. We must ensure that those who have been diligent in paying their dues are not unfairly burdened because of inefficiencies in management.

Conclusion:

The data speaks for itself—95% average collections clearly indicate that additional fundraising is unnecessary. The management must prioritize accountability, focus on recovering dues from defaulters, and operate efficiently without penalizing prompt payers. Residents must hold the management accountable to protect the financial well-being of the community and prevent undue hardships on compliant members.

Let’s ensure fairness, transparency, and effective management for our community.